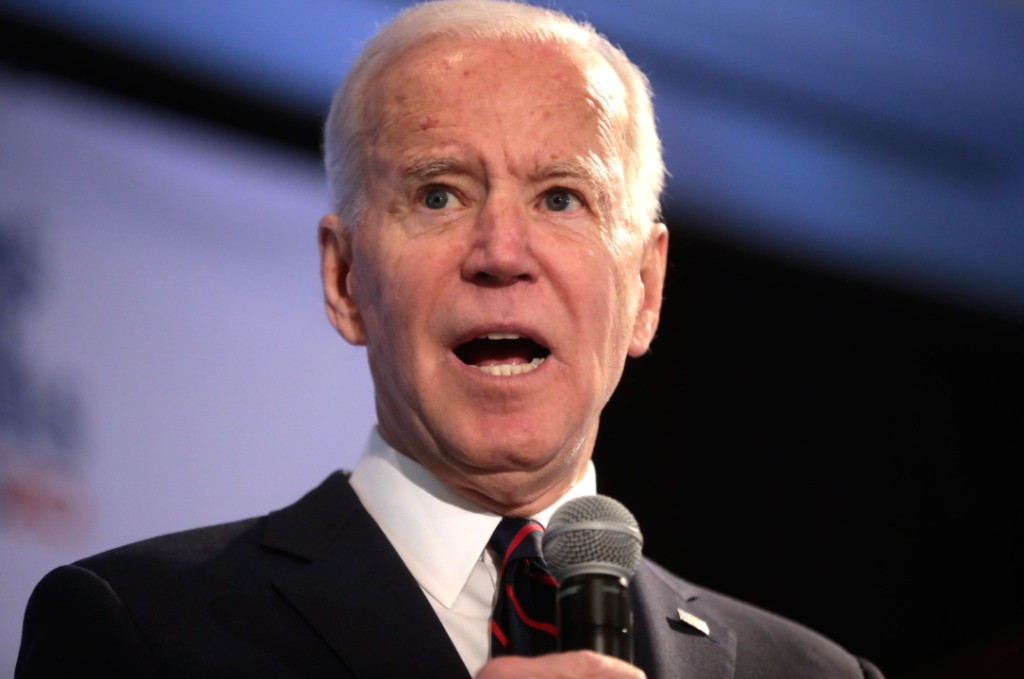

Several Democratic lawmakers and clean energy advocacy groups, typically allies of President Biden’s environmental policies, are expressing concerns over the administration’s recent guidance on green energy tax credits, particularly those related to hydrogen power production. This guidance is part of the Inflation Reduction Act (IRA), a significant climate and tax bill signed by President Biden in August 2022.

Jason Grumet, CEO of the American Clean Power Association, a clean power industry group, has highlighted what he perceives as a critical flaw in the administration’s proposal. He contends that the proposal, while aiming to kickstart a green hydrogen industry, imposes overly restrictive standards too quickly, failing to consider the market realities of deploying new technologies.

The hydrogen production tax credits under the IRA are substantial, estimated to be worth up to $100 billion, and are seen as pivotal for encouraging the growth of hydrogen generation. Hydrogen, particularly when produced through electrolysis (splitting hydrogen from water using electricity), is considered a vital component in efforts to decarbonize various sectors. However, environmentalists argue that the benefits are negated if the electricity for electrolysis comes from fossil fuel sources.

The Treasury Department’s guidance specifies that to qualify for the highest tax credit, hydrogen producers must use electricity from green sources like wind or solar that came online within three years of a new facility’s operation. This stipulation excludes facilities powered by older renewable energy sources. Additionally, starting in 2028, hydrogen developers must ensure that their electricity generation from clean sources aligns on an hourly basis with hydrogen production.

Several Democratic senators, including Tom Carper (Delaware), Sherrod Brown (Ohio), and Bob Casey (Pennsylvania), have raised concerns about this guidance. Senator Carper applauds the administration’s efforts but fears the proposed rule might not effectively support the clean hydrogen industry’s development. He emphasizes that the IRA intended the clean hydrogen incentives to be flexible and technology-neutral, a goal he feels is not fully reflected in the draft guidance.

Senator Brown warns that the proposed rules could slow down and undermine the U.S.’s ability to produce clean, affordable hydrogen, diverging from the IRA’s intention to foster clean energy innovation. Senator Casey echoes similar concerns, focusing on the potential impact on Pennsylvania workers and businesses, urging the administration to consider their interests and ensure the state can fully benefit from the tax credit as Congress intended.

Before the announcement, these senators, along with nine other Democrats, had requested more lenient guidance from the Biden administration, suggesting a progressive tightening of standards over the next decade.

The debate highlights the challenges in balancing ambitious climate goals with practical market and technological considerations, especially in sectors like transportation and industry, which significantly contribute to U.S. end-use emissions. The administration’s response and potential adjustments to the guidance will be crucial in shaping the future of the U.S. clean hydrogen industry.