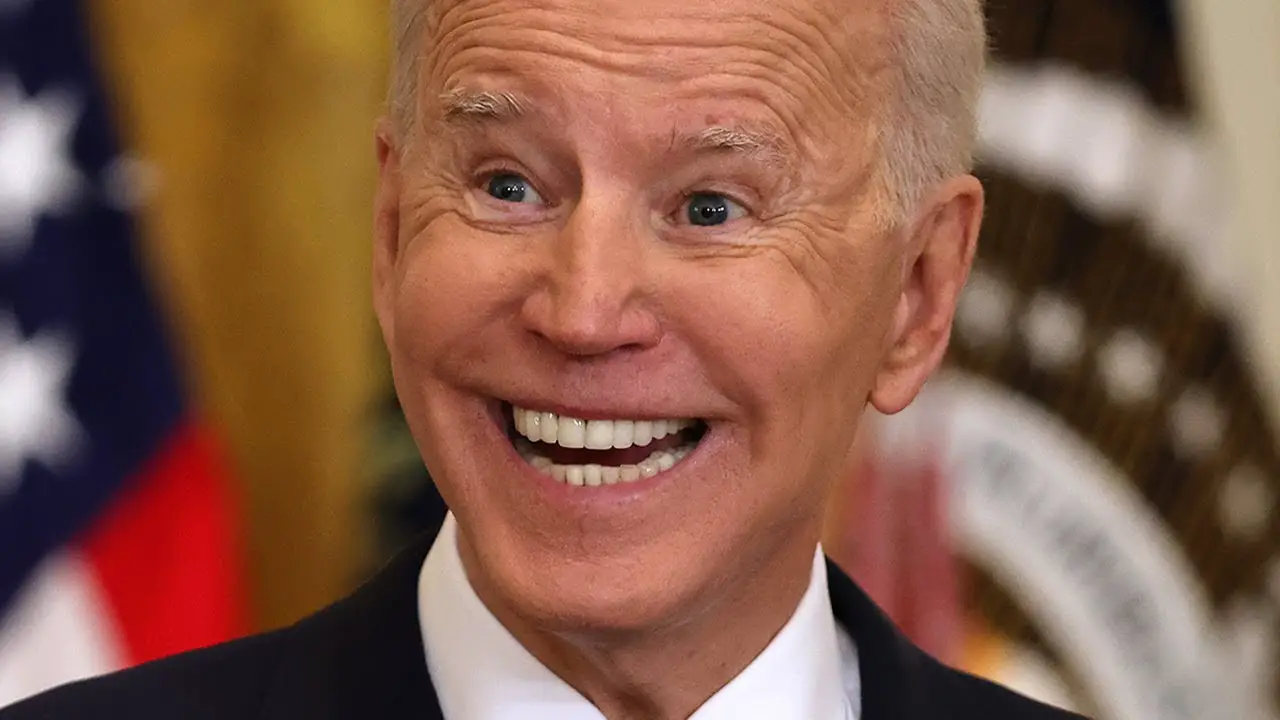

The recent plan from Old Uncle Joe to take strides to forgive billions in student debt could quite soon come back to bite the very same people it was created to assist.

People who took the benefits from the new plan — which included up to 10,000 in loan forgiveness for those making under $125,000 annually and up to $20,000 for those who received a Pell Grant– could end up discovering that they have a state tax bill to the tune of up to $1,100 if the states in which they live to not label the money coming from the federal government to deal with student loan debt as non-taxable income.

As stated in a recent analysis handed out by the Tax Foundation, the student borrowers from quite a few different states could see even more taxes — in the ballpark of $300-1,100– unless their states quickly take action to alter the tax code before the end of the year.

Normally, debt that has been discharged is considered normal income for other state and federal tax purposes, but a recent special section slotted into President Biden’s American Rescue Plan Act (ARPA) creates an exception for forgiven student debt when it comes to federal tax filings. This has not happened, however, for quite a few different states that have, as of writing, not chosen to conform with the federal provision handed down. This means that any borrowers living in these states would still be forced to pay taxes on the money being forgiven by the federal government as though they had earned it as income.

While the overall amount that the borrows could be possibly taxed for is just a small portion of what the total amount of forgiven debt might be, the original loan could have been paid off over time in smaller payments but the tax bill will be due in its entirety on April 15th. In the same vein, a spike in taxable annual income to the tune of $10,000-$20,000 could end up pushing some borrowers into higher tax brackets and cause them to face higher taxes for the rest of their years incoming as well.

Currently, the states in which the student borrowers are going to have to deal with this insane taxation rate from their states regarding the forgiven student loans are as follows: Arkansas, Minnesota, Mississippi, North Carolina, and Wisconsin.

Student loan borrowers in 5 states could be forced to pay $500-$1K in taxes on forgiven loans, says a new analysis.

The Tax Foundation says while Biden's loan forgiveness is not federally taxable, it may still be counted as taxable income under state laws in AR, MN, MS, NC, WI. pic.twitter.com/NDSNJowr0U

— AJ+ (@ajplus) August 31, 2022

Additionally, in another pair of states, California and Pennsylvania, many officials have stated that despite any such ambiguity still present in the state tax code, they will go along with the adoption of the ARPA provision from the federal government and the forgiven amount will not be taxed.