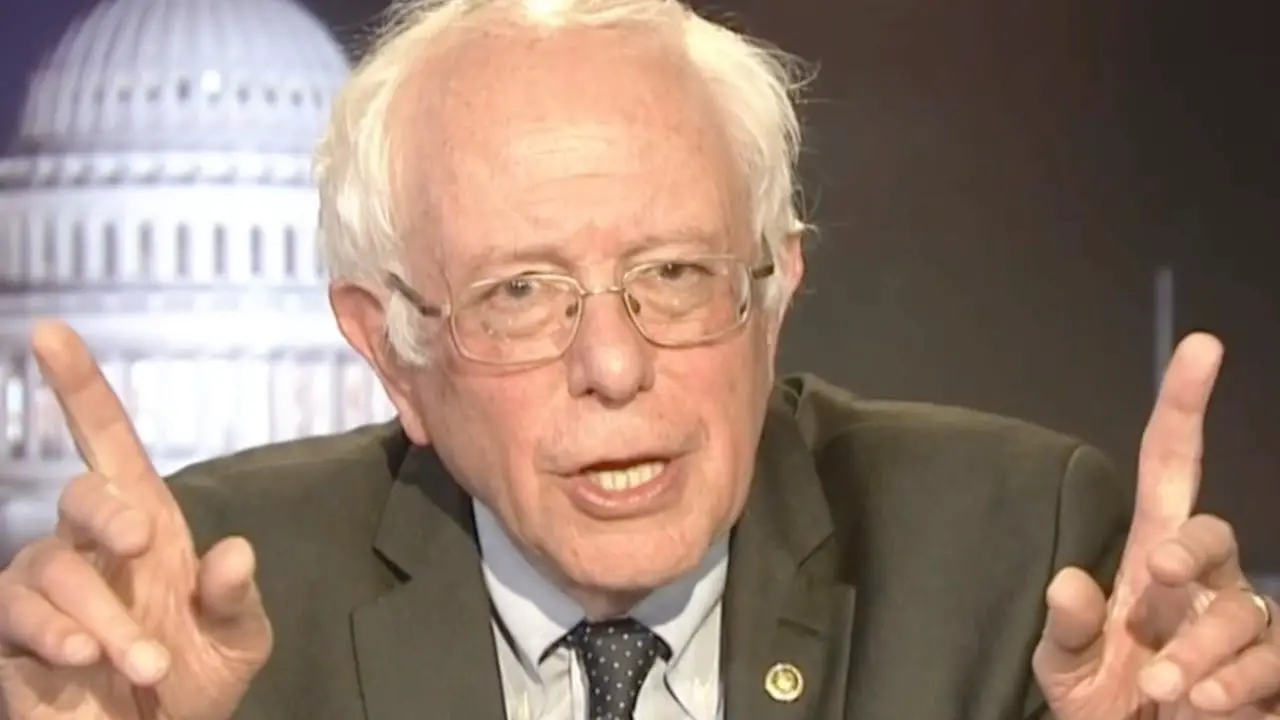

It’s a given that presidential-hopeful-turned-failure Bernie Sanders wants a universal healthcare system place in The United States. He’s certainly not been quiet about it and it’s something many of his followers support.

So he’s decided to hit the bricks again by proposing the latest single-payer health care system scheme dubbed “Medicare for All”. The price tag, though… well it’s nucking futs. Not to mention his wealth and how little he paid out in taxes.

From Buzzfeed:

When he introduced his Medicare-for-all bill last week, Bernie Sanders also put down on paper the idea he’s been talking about, sometimes loudly, sometimes with caution, other times not publicly at all, f0r more than 20 years: a “wealth tax” in the United States.

In 1997, in his book, Outsider in the House, he declared it “high time to establish a tax on wealth similar to those that exist in most European countries.” Nine years later, during his first race for U.S. Senate, his opponent quoted the passage online, printed it on brochures, and pushed it in statements: “Sanders’ European-style wealth tax,” on “everything they own every year. Every tractor, cow, and acre.” In response, the Sanders campaign argued that he had never formally proposed a wealth tax, just floated the idea.

As reported by Jazz Shaw for Hot Air:

Sanders was largely mute on that subject until just recently. But now he’s gingerly stepped forward and begun to sketch out at least one way to raise part of the money. It’s an old chestnut from the socialist movement having some fresh life breathed into it, known as a “wealth tax.” (Buzzfeed)

This is not a tax on new income for the year or even carried interest. It’s an audit of everything you’ve managed to acquire throughout your life, followed by the receipt of a tax bill calculated based on your total net worth.

Let’s be clear about one thing here. A so-called “wealth tax” can be readily defined as follows: It’s the death tax, only they make you pay it every year long before you’ve died. Even if you earn no money in a given year after your retirement or receive no interest payments on your savings, if you own a house, a car, a vacation property or, hypothetically a cow, a tractor and an acre of farmland, you will have to come up with the cash to pay the government a percentage of that total value. And if you live long enough in that static condition, they will eventually tax you until you have nothing.